San Diego Home Insurance Things To Know Before You Get This

Obtain the Right Defense for Your Home With Tailored Home Insurance Coverage Protection

Tailored home insurance policy protection offers a safety and security internet that can supply tranquility of mind and economic protection in times of dilemma. Browsing the complexities of insurance policies can be daunting, specifically when attempting to identify the specific coverage your unique home needs.

Significance of Tailored Home Insurance

Crafting an individualized home insurance plan is important to make certain that your coverage precisely shows your specific requirements and situations. A customized home insurance plan surpasses a one-size-fits-all strategy, supplying you particular security for your distinct scenario. By functioning carefully with your insurance coverage provider to tailor your plan, you can ensure that you are appropriately covered in the event of a claim.

One of the key benefits of tailored home insurance policy is that it permits you to include coverage for products that are of certain worth to you. Whether you have expensive jewelry, uncommon art work, or specific devices, a customized plan can ensure that these ownerships are protected. Additionally, by tailoring your insurance coverage, you can adjust your deductibles and limitations to align with your danger tolerance and financial capabilities.

Furthermore, a customized home insurance coverage considers variables such as the area of your residential or commercial property, its age, and any type of distinct attributes it might have. This tailored method aids to reduce prospective gaps in insurance coverage that might leave you revealed to threats. Eventually, investing the moment to tailor your home insurance coverage plan can give you with comfort knowing that you have thorough defense that satisfies your particular needs.

Evaluating Your Home Insurance Policy Demands

When considering your home insurance needs, it is vital to assess your specific situations and the specific risks connected with your residential or commercial property. Analyze the age and condition of your home, as older homes might require more upkeep and could be at a higher danger for problems like pipes leaks or electric fires.

In addition, take into consideration any type of additional frameworks on your home, such as sheds, garages, or pool, that might require coverage. Consider your obligation dangers as a house owner, consisting of the capacity for crashes to take place on your residential or commercial property. By extensively examining these elements, you can identify the level of protection you need to effectively protect your home and possessions (San Diego Home Insurance). Keep in mind, home insurance policy is not one-size-fits-all, so customize your plan to fulfill your particular demands.

Customizing Coverage for Your Home

To customize your home you can try here insurance coverage policy effectively, it is vital to customize the protection for your certain residential property and private demands. When customizing protection for your home, consider variables such as the age and building and construction of your home, the value of your items, and any kind of one-of-a-kind features that may need special protection. For circumstances, if you own costly jewelry or artwork, you might require to include added insurance coverage to protect these products sufficiently.

Moreover, the area of your building plays a crucial check my reference function in tailoring your coverage (San Diego Home Insurance). Houses in areas prone to natural catastrophes like floodings or earthquakes may call for added coverage not included in a standard policy. Comprehending the risks related to your area can assist you tailor your protection to reduce potential damages successfully

Additionally, consider your way of life and personal choices when customizing your protection. You may want to add coverage for theft or criminal damage if you frequently take a trip and leave your home unoccupied. By customizing your home insurance coverage to match your certain requirements, you can make sure that you have the appropriate security in place for your home.

Recognizing Plan Options and Limits

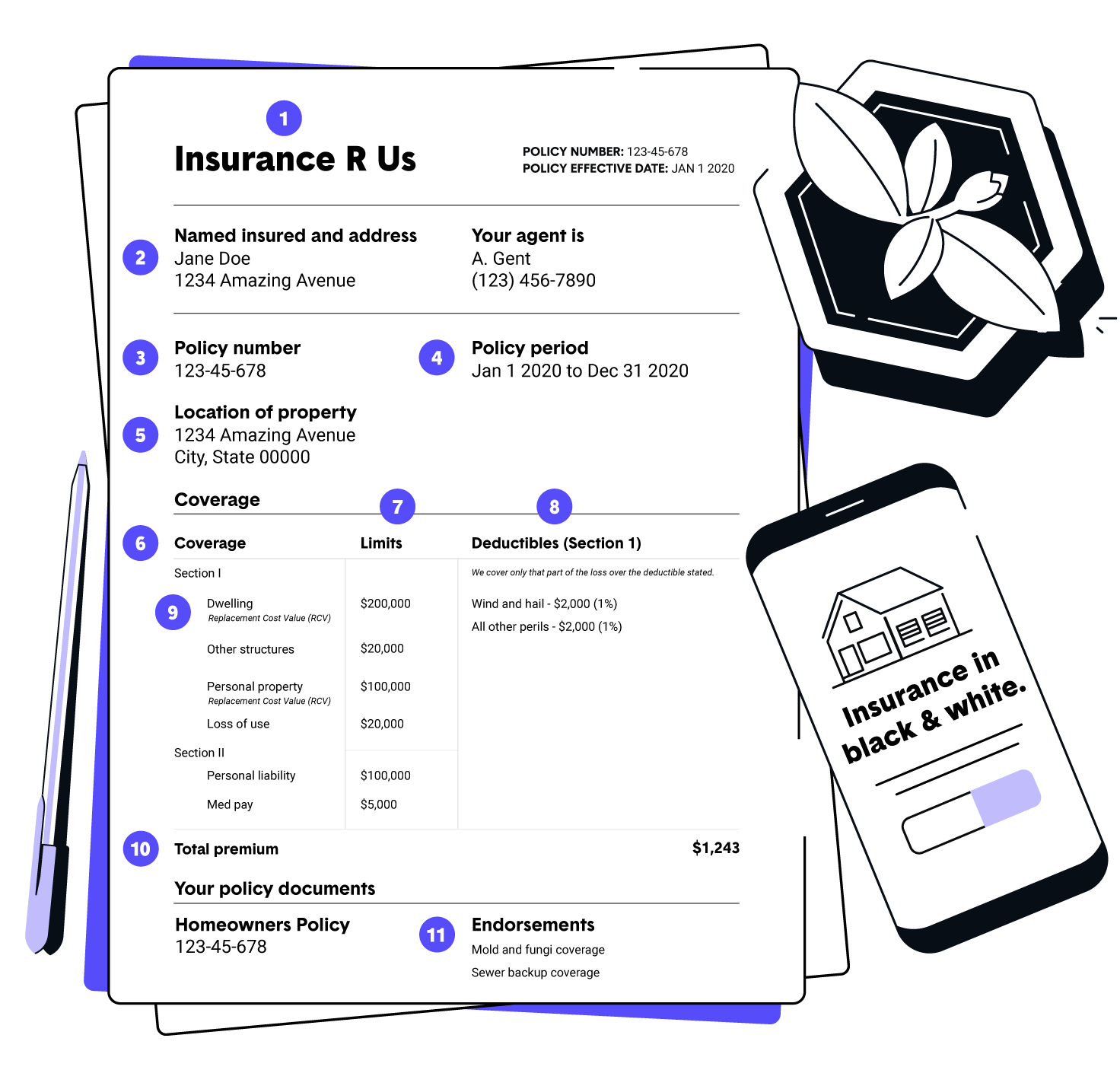

Checking Web Site out the various plan choices and limits is essential for acquiring a detailed understanding of your home insurance coverage. Policy options can consist of coverage for the framework of your home, personal valuables, responsibility protection, added living costs, and much more. By carefully taking a look at plan alternatives and restrictions, you can tailor your home insurance policy protection to provide the security you need.

Tips for Selecting the Right Insurance Firm

Recognizing the value of choosing the appropriate insurance firm is vital when guaranteeing your home insurance coverage lines up flawlessly with your needs and supplies the essential security for your properties. When picking an insurance company for your home insurance policy, consider factors such as the company's online reputation, monetary stability, consumer service high quality, and protection options. By following these suggestions, you can make an educated decision and choose the best insurance company for your home insurance policy requires.

Verdict

Crafting an individualized home insurance coverage policy is vital to ensure that your coverage accurately reflects your specific requirements and circumstances (San Diego Home Insurance). Assess the age and condition of your home, as older homes may require more maintenance and might be at a greater danger for problems like pipes leaks or electric fires

To customize your home insurance plan effectively, it is crucial to tailor the protection for your details home and specific needs. When personalizing coverage for your property, consider aspects such as the age and building and construction of your home, the worth of your personal belongings, and any kind of distinct functions that might call for special insurance coverage. By closely examining policy choices and limits, you can customize your home insurance policy coverage to offer the defense you require.